Leading with Science® to create a more sustainable future

Our greatest impact on the world is through our projects and using technology to improve and protect communities and the environment.

Tetra Tech reports on how we advanced our environmental, social, and governance goals and improved lives around the world in 2023.

Leading with Science

We are changing lives through science, technology, and innovation. Our goal is to improve the lives of 1 billion people around the world by 2030 by helping to create more resilient and sustainable communities. Learn more about our commitment.

Strengthening safe water supplies in communities around the world

We help address mounting water challenges due to climate change impacts, emerging contaminants, and population pressures.

Accelerating the transition to cleaner, renewable sources of energy

We combine innovative solutions, local expertise, and regulatory knowledge to bring energy projects to market.

Advancing biodiversity conservation and restoration worldwide

We use the latest technology and analytics to address the drivers of biodiversity loss and implement nature-based solutions.

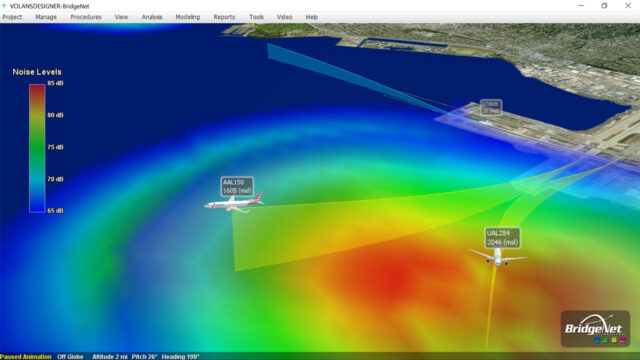

Unparalleled insight

Our Tetra Tech Delta suite of digital solutions encompasses advanced data analytics, artificial intelligence, and technologies that create transformational solutions for our clients.

Explore our solutions

Connect with us. Reach out to our experts.

Create a sustainable future with us

Our people around the world are supporting our mission and vision for a sustainable world. Join us today.